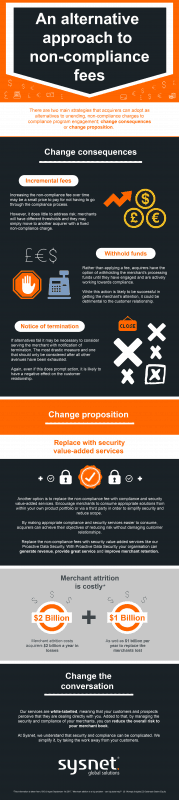

An alternative approach to non-compliance fees

Despite various approaches that some acquirers take to try and engage with businesses when it comes to compliance programs, some merchants simply do not engage. The traditional approach of driving compliance via non-compliance fees unfortunately doesn’t always produce results and can also lead to a negative association with the brand of the acquirer in the eyes […]