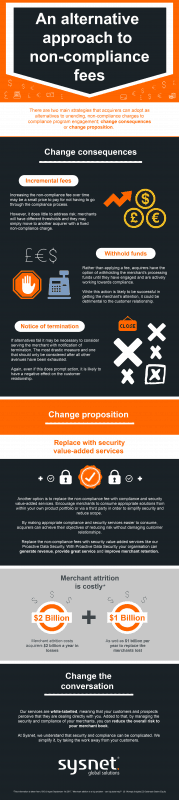

Sysnet Launches Tailored PCI DSS Solution for Payment Facilitators

October 2, 2019, Dublin, Ireland – Atlanta, Georgia – London, United Kingdom – Sysnet Global Solutions has announced the launch of its PCI DSS solution designed to help payment facilitators, their sub-merchants, and their Acquirers increase PCI compliance and reduce risk. The PCI DSS (Payment Card Industry Data Security Standard) is a set of […]